As the cannabis industry expands in South Dakota, the availability of CanPay dispensaries and retailers is creating a more convenient and secure way for consumers to pay. CanPay, a leading payment solution, is specifically designed for cannabis and other regulated markets. Here’s why CanPay is making a difference in South Dakota:

15-Year Track Record: CanPay leverages 15 years of experience to offer a seamless payment network connecting customers, merchants, banks, and tech providers.

Fee-Free Convenience: Say goodbye to ATM fees and cash-related hassles. CanPay allows users to purchase cannabis products without incurring additional costs.

Safety First: Eliminating cash from the equation reduces the risks associated with carrying physical currency, offering secure and confidential transactions.

Cutting-Edge Security: CanPay’s advanced security measures ensure that only you can authorize purchases, protecting your financial data.

Simple and Debit-Based: The CanPay app generates a unique payment PIN for each transaction, directly debiting your checking account for the exact amount of the purchase.

Sign up for CanPay and experience the convenience today!

Why South Dakota Retailers Should Choose CanPay

South Dakota retailers can Integrate CanPay into your business and provide numerous benefits, ensuring secure and efficient transactions. Here’s how:

- Specialized Network: CanPay partners with banks and tech providers that understand the unique needs of regulated industries.

- Customer Loyalty: Offering CanPay enhances customer satisfaction and encourages repeat business.

- Improved Safety: Minimize cash handling to create a safer environment for staff and customers alike.

- Cost Efficiency: CanPay is designed for sustainability, offering affordable electronic payment solutions.

- Familiarity and Ease: Customers can use CanPay without needing to learn new systems—it integrates seamlessly into their existing payment habits.

- Upselling Opportunities: Electronic payments allow for spontaneous purchases, boosting sales at checkout.

Make CanPay your go-to payment solution for a safer, more efficient retail experience in South Dakota.

Why South Dakota Financial Institutions Choose CanPay

South Dakota financial institutions can gain significant advantages by integrating CanPay’s debit network, tailored for regulated markets like the cannabis industry:

- Regulatory Compliance: CanPay ensures all transactions meet strict compliance standards, fostering transparency.

- Closed-Banking Feedback Loop: Only cannabis retailers with compliant bank accounts participate in the network, ensuring legitimacy.

- Cost Savings: Reduced cash handling minimizes operational costs and enhances security.

- Stability and Growth: CanPay is purpose-built to meet the unique needs of the cannabis market, providing a stable and trusted payment solution.

Why CanPay for Your Cannabis Banking Clients?

- Transparency (1): Retailers conduct business under their Doing Business As (DBA) name, ensuring transparency throughout the payment process.

- Transparency (2): All participants in the payments chain fully understand the industries involved, fostering trust and clarity.

- Cost-Effective: CanPay offers sustainability at a fair value for retailers, minimizing costs.

- Legitimacy: The Closed-Banking Feedback Loop ensures that only retailers with compliant bank accounts participate in the payment network.

- Stability: CanPay is purpose-built to meet the industry’s unique needs and requirements.

- Safety (1): By reducing cash usage, CanPay contributes to safer communities.

- Safety (2): Clients benefit from a cashless system, enhancing security.

- Safety (3): Bankers appreciate fewer cash-related risks and fewer retailer visits to branches with large amounts of cash.

- Cost Savings: Less cash handling by staff and fewer cash pickups lead to operational savings.

- It’s Better For Business: your retail clients will enjoy increased sales with electronic payments.

As part of your cannabis banking program, your clients gain access to compliant banking services. But that’s not all! By participating in CanPay’s Closed-Banking Feedback Loop, you provide them with a secure and transparent payment solution. Contact us today and open up the CanPay network for your valued clients.

Choose CanPay for a safer, more efficient, and cost-effective payment solution!

About South Dakota

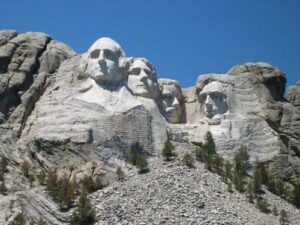

As the 40th state to join the Union in 1889, South Dakota is home to iconic landmarks such as Mount Rushmore and Badlands National Park.

South Dakota’s mix of natural beauty and historical significance makes it a top destination for both visitors and residents.

Points of Interest in South Dakota:

- Mount Rushmore National Memorial: One of America’s most famous landmarks, featuring the carved faces of four U.S. presidents.

- Badlands National Park: A striking landscape of rugged rock formations, canyons, and prairie lands, perfect for hiking and photography.

- Custer State Park: A haven for wildlife enthusiasts, offering bison herds, scenic drives, and camping opportunities.

- Wind Cave National Park: Explore one of the world’s longest caves, featuring unique boxwork formations.

Where to Use the CanPay App in South Dakota

A growing number of dispensaries in South Dakota accept CanPay. Check with your local dispensary to verify availability.

Frequently Asked Questions About CanPay

What is CanPay used for?

CanPay is a mobile debit app specifically designed for cannabis retailers and other regulated businesses.

Is CanPay secure?

Yes, CanPay employs the latest security technology. Payment codes are single-use and expire after 30 minutes.

Can I use a credit card with CanPay?

No, CanPay links directly to your checking account for debit-based transactions.

Is there a daily limit for CanPay?

Yes, users can spend up to $500 per day using CanPay.

Who owns CanPay?

CanPay, founded by Dustin Eide, is based in Littleton, Colorado.

More FAQs

Choose CanPay for a safe, efficient, and cost-effective payment experience in South Dakota!