CanPay: The Smarter Way to Pay for Cannabis in California.

As the number of California CanPay Dispensaries and retailers continues to grow, having a reliable and secure payment solution becomes essential. CanPay, a trusted provider, caters not only to cannabis but also to other regulated emerging markets within the state. Here’s why CanPay stands out:

15-Year Track Record: With a 15-year history, CanPay has built a unique network connecting customers, merchants, banks, and tech providers. Our extensive experience ensures a seamless payment process for all users.

Fee-Free Convenience: As a CanPay user, you can purchase cannabis products without any extra fees. Say goodbye to inconvenient ATM visits or unexpected bank charges.

Safety First: By minimizing cash usage, CanPay creates a safer environment for both customers and staff. Say goodbye to the risks associated with handling physical currency.

Cutting-Edge Security: Our advanced security measures ensure that only you can authorize purchases using your CanPay account.

Simple and Debit-Based: Generate a unique payment PIN within the CanPay app, and you’re all set. Debits are made directly from your checking account, matching the exact purchase amount.

Ready to get started?

Sign up for CanPay and download the CanPay app today!

Why California Retailers Should Choose CanPay

As a trusted and secure electronic payment option, CanPay enables California retailers to conduct transactions smoothly. Here’s why adopting CanPay is a wise decision for your business:

Specialized Network and Effortless Transactions:

CanPay partners with a network of banks and technology allies who are well-versed in the specific needs of California retailers. This specialized network ensures that electronic debit payment processing is streamlined at your locations, facilitating effortless transactions with minimal disruption.

Improved Customer Satisfaction and Loyalty:

Using CanPay boosts customer satisfaction and fosters loyalty. Customers are likely to spend more when they can pay electronically as opposed to using cash only. CanPay provides a convenient and familiar payment method that encourages repeat visits.

Enhanced Safety and Risk Reduction:

Reducing cash transactions is essential for safety. CanPay removes the need to handle physical cash, thus decreasing the risks related to theft, loss, and mismanagement. Both customers and staff enjoy a safer environment in your retail setting.

Cost-Effective Solution:

CanPay is crafted to be sustainable and economical. Enjoy the advantages of electronic payments without substantial costs. Choosing CanPay allows you to manage your payment processing efficiently while keeping expenses in check.

Seamless Integration and Upselling Opportunities:

CanPay fits smoothly into your current payment routines. Customers face no hurdles in learning new procedures, making the switch seamless. Additionally, at the point of sale, your staff can leverage upselling opportunities as customers are not limited by the cash they have on hand.

Increased Sales and Dependable Transactions:

CanPay attracts customers who prefer this convenient mode of payment. You can be confident that all transactions are conducted through U.S.-based financial networks, ensuring reliable and secure transfers.

In summary, CanPay delivers a safer, more streamlined payment process that is beneficial for both your business and your customers. Ready to upgrade your retail operations? Sign up for CanPay and offer your customers a dependable payment solution!

Why California Financial Institutions Choose CanPay

California’s financial institutions stand to gain by adopting CanPay, a secure debit network tailored for highly-regulated and emerging markets, including the State Regulated Cannabis Industry. Here’s why CanPay is an exceptional choice:

Compliance and Safety:

CanPay facilitates electronic payments between consumers and retailers in compliance with regulatory standards. Retailers with compliant bank accounts at CanPay-approved banks can effortlessly connect to the network and process debit payments from customers.

Closed-Banking Feedback Loop:

CanPay ensures participation is limited to cannabis retailers who work with banks adhering to the Cole Memo and FinCEN Guidance. Feedback from these banks confirms the legality of transactions from licensed and compliant retailers.

Robust Compliance Program:

CanPay’s ODFI (Originating Depository Financial Institution) upholds a stringent compliance program aligned with the Cole Memo and FinCEN Guidance. Opt for CanPay for a safer, more effective payment solution that benefits both your financial institution and your customers!

Why Choose CanPay for Your Cannabis Banking Clients?

- Transparency: Retailers operate under their Doing Business As (DBA) names, which maintains transparency throughout the payment process.

- Industry Awareness: All parties in the payment chain are fully aware of the involved industries, enhancing trust and transparency.

- Cost-Effective: CanPay offers sustainable services at reasonable costs for retailers, minimizing expenses.

- Legitimacy: The Closed-Banking Feedback Loop guarantees that only retailers with compliant bank accounts are involved in the payment network.

- Stability: CanPay is designed specifically to address the unique demands and requirements of the industry.

- Enhanced Safety: By reducing cash usage, CanPay helps create safer communities.

- Security Benefits: Clients benefit from a cashless system that heightens security and reduces cash-related risks, reducing the need for frequent branch visits with large cash deposits.

- Operational Savings: Less cash handling and fewer cash pickups lead to cost reductions.

- Business Advantages: Your retail clients will see increased sales with the option of electronic payments.

Ready to improve your cannabis banking services? Sign up for CanPay today!

As part of your cannabis banking program, your clients will access compliant banking services and a secure, transparent payment system through CanPay’s Closed-Banking Feedback Loop. Contact us today to open the CanPay network for your valued clients.

Choose CanPay for a safer, more efficient, and cost-effective payment solution!

About California

The state’s economy is the largest in the U.S. and would rank among the largest in the world if California were an independent country. It is a global hub for technology and innovation, primarily centered in Silicon Valley, home to many of the world’s largest tech companies and startups. Besides tech, California’s economy is also bolstered by industries such as entertainment, with Hollywood being synonymous with the film industry, as well as agriculture, manufacturing, and tourism.

Culturally, California is known for its progressive stance on many social issues and its influence on global culture through music, film, and art. It is a melting pot of cultures, with a significant portion of its population coming from various immigrant backgrounds, which adds to the cultural richness and diversity of the state.

California’s educational system includes some of the top universities in the world, such as Stanford University and the University of California system, which includes UCLA and UC Berkeley. The state also boasts an extensive network of state and national parks, preserving the natural landscapes and providing recreation for all. Notable natural landmarks include Yosemite National Park, Lake Tahoe, and the Redwood National and State Parks.

The state’s political influence is significant both on a national and international scale, often leading the way in environmental policies and other progressive legislations. Despite its many strengths, California faces challenges such as wildfires, droughts, and issues related to urbanization and housing affordability. Nevertheless, California continues to be a place of innovation, culture, and natural beauty, attracting people from all over the world.

Points of Interest in California

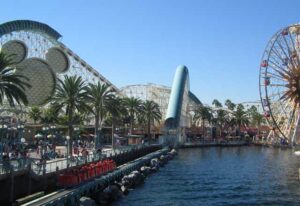

Disney Land: Discover the excitement of the Disneyland Resort in Anaheim, California, featuring 2 amazing theme parks—Disneyland Park and Disney California Adventure Park!

Joshua Tree National Park: Two distinct desert ecosystems, the Mojave and the Colorado, come together in Joshua Tree National Park.

Golden Gate Bridge: Visiting the world famous Golden Gate Bridge is a unique experience for everyone. Whether you hike, walk, bike, shop, take a guided tour, or just sit back and take it all in, there is something for everyone.

Universal Studios Hollywood: A film studio and theme park in the San Fernando Valley area of Los Angeles County, California.

Where to Use the CanPay App In California

A current list of California CanPay Dispensaries and Retailers

Frequently Asked Questions

What is the purpose of CanPay? CanPay is the world’s first mobile debit application tailored for cannabis retailers and emerging market businesses. It operates similarly to the debit cards in your wallet and is accepted at authorized cannabis retailers.

Is CanPay safe to use? Yes, CanPay incorporates the latest in security technology. The Payment Code generated within the CanPay app is single-use and expires 30 minutes after generation.

Can I link a credit card to CanPay? CanPay is designed to link directly with your checking account only.

Are there any fees associated with CanPay? CanPay imposes a fee on merchants of less than 2% of the transaction for processing, which is conducted through scanning a QR code from a customer’s phone either in-person or on a website.

What is the daily spending limit for CanPay? You can transact up to $500 daily using your CanPay debit account. It functions like typical debit and credit cards, deducting the exact transaction amount from your checking account at the time of purchase.

Who owns CanPay? CanPay is headquartered in Littleton, Colorado, and was established by Dustin Eide.

What is ‘Purchasing Power’ in CanPay? Purchasing Power allows you to pay for purchases over time through interest-free installments, with no risk. This enables you to shop for your favorite brands and manage payments with low monthly installments, making it easier to budget for big purchases or upgrades.

Is there a mobile app available for CanPay? Yes, once your account is established, you can download and use the secure CanPay app.

Choose CanPay for a convenient, secure, and efficient payment experience!